These solutions connect employees across the enterprise, ensuring that the budgets have the same readable format no matter who prepares them.īetter forecasting. Overall, this can halve the amount of time spent on the budget cycle.

This saves time on process creation (no need to create an Excel file), allows for data to be saved and reused year over year and makes the budgets easier to manage and amend. Budgeting and forecasting software contains high-level functionality specifically dedicated to this purpose. A good budgeting program eliminates most of the opportunities for calculation errors, increasing overall accuracy of the process.įaster and simpler. The tight deadlines and overtime hours associated with the budgeting cycle make it an error-prone process, but a single human error can have a massive impact on a company’s profitability. This information needs to be integrated in a seamless, intelligent way.Ī strong budgeting and forecasting system improves accuracy for budgeting and long-term business development planning. They need something that can handle multiple types of expenses and multiple sources of revenue, all coming from different users in different departments. Large corporations. Large companies with dozens or hundreds of different departments create a whole other level of complexity in the budgeting and forecasting process. However, many different factors play a part, and the ability to predict changes in those factors can prevent massive overinvestment in your company’s infrastructure. A common mistake for growing businesses is to assume that last year’s surge will carry over into this year. Mid-sized and growing businesses. Slightly larger and rapidly growing businesses can benefit from a system that adds forecasting features to help predict future growth and sales based on past patterns. Budgeting is a critical feature here, but often forecasting capabilities and needs are somewhat limited, due to costs and lack of historical data. Small businesses. Small and fledgling businesses may want to pay particular attention to a user-friendly interface or more intuitive presentation styles, which can produce easily understandable graphs and charts. These scenarios improve general awareness of potential obstacles ahead, providing greater foresight in budget formation.Īlthough some of the most important points of the budgeting and forecasting process are the same across industries, different organizations have different priorities and requirements in finding the right system. Hypothetical forecasting also allows for the inclusion of complex or often-forgotten factors like inflation. But with business forecast systems, the budget approval process can be standardized to improve organization and communication.

#Free budgeting software for small business manual#

When certain areas of a company’s budget are headed by different individuals, manual collaboration can be troublesome. In addition, the ability to connect and interact with other programs provides consolidated data collection, as well as a variety of different ways to complete the budgeting and forecasting process.Ĭollaboration in budget formulation becomes much easier with the use of budgeting and forecasting solutions. This automated importing strengthens consistency and completeness for data analysis that is reliable and error-free. With the right system, however, automated reminders can ensure that the user knows when to input key business information for budget analysis.Įffective business budget software can also automatically import data directly from integrated accounting applications, including the general ledger, ERP system and HR system. Negligence and typos can easily destroy the validity of budget strategies. Because budgets are formulated by the recording of business data, human error can drastically affect the budgeting process. Like many budgeting programs, business forecasting software reduces the opportunity for potential human error. What Is Budgeting and Forecasting Software?

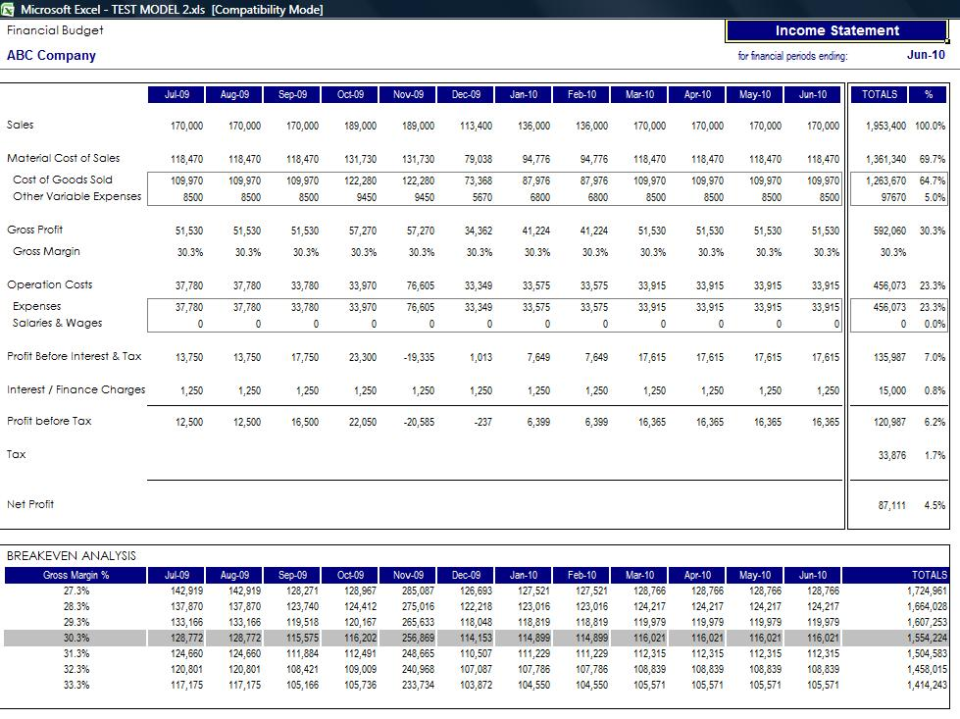

With the help of business budgeting software, businesses can forecast likely future expenses, establish more precise and realistic budgets and have a greater chance of achieving ongoing profitability. The long-term survival of a business depends on its ability to establish a budget and operate within its confines. Financial planning software applications utilize historical data and estimates of future conditions to track a company’s financial progress and compare it to business expectations.

0 kommentar(er)

0 kommentar(er)